Our sources are reporting that factory health restrictions and labor shortages are causing delays in production which result in long lead times. With continued demand it has been difficult for factories to keep material and product in stock. The number one disrupter going into Q1 2022 is labor shortage, as most manufacturers and local subcontractors can attest.

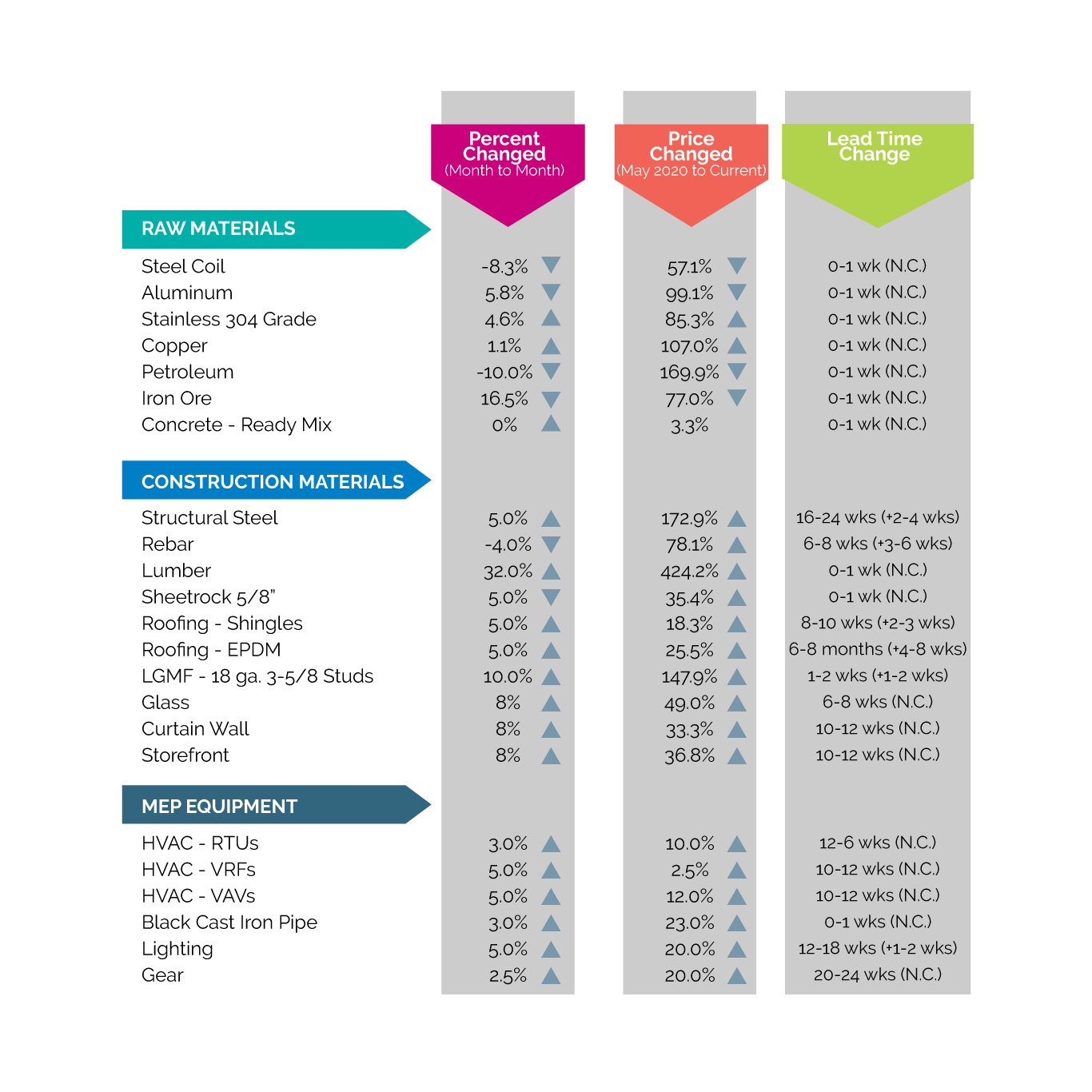

Building material cost has gone up across the board since the beginning of the year, notably lumber prices again. The price for lumber has risen 425% since May 2020 when we started tracking. This last month alone it has risen another 32%. Structural steel pricing went up as well, As per Nucor standards. Lead times are lengthy for main structural components, metal decking and bar joists which are seeing 8 – 9 months for delivery. Roofing has been a roller coaster this past year as well. Coming into the new year EPDM and shingles continue with long lead times and cost increases with the price of petroleum fluctuating weekly. Mechanical equipment lead times are somewhat stable but longer than usual. Pricing for mechanical equipment has increased per manufacturer standards as per our local subcontractors.