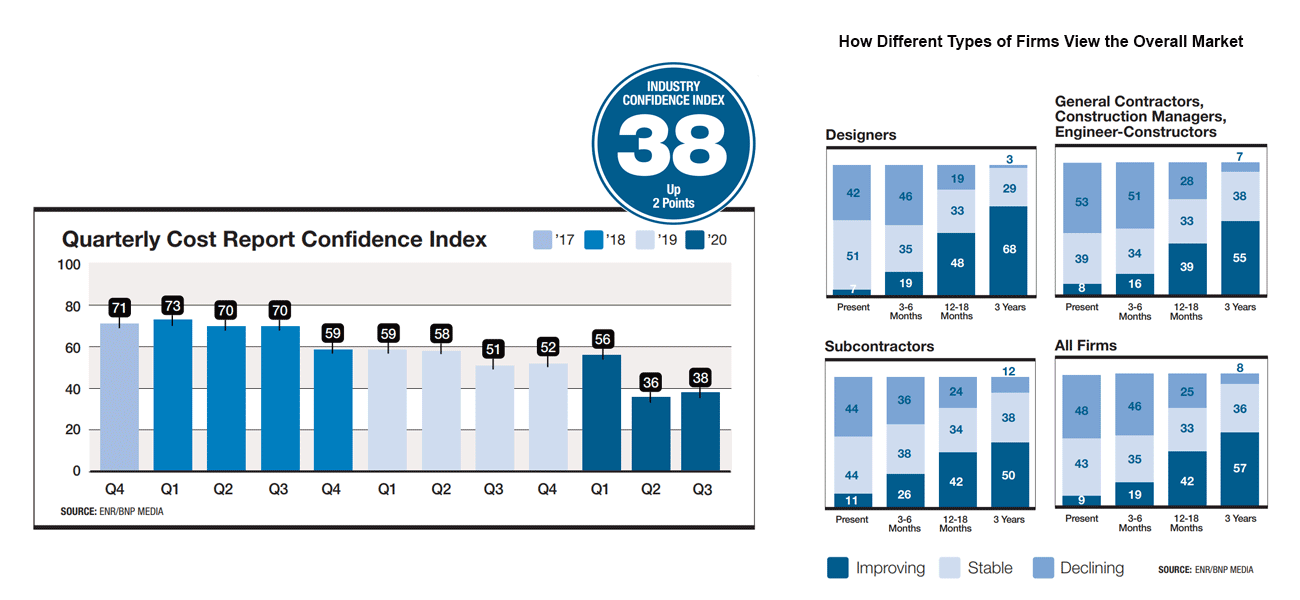

Not quite. As we enter the final quarter of 2020, we are adjusting to life with COVID-19 and all the effects it has caused. As we review the prior quarter, we have seen some encouraging signs which help to offset some challenges that persist.

So what are the prospects for design and construction to end 2020?

Construction is on the road to recovery. Design and construction firms have fared better than many other businesses (i.e. airlines.) Prices for material other than lumber have begun to stabilize. Construction employment has increased from the previous month. Many industry leaders and pollsters have found that major concern lies with the expiration of federal aid provided by the CARES Act. This also has great effect on public projects moving forward. In general, most design and construction groups believe the recovery will continue through late 2021.

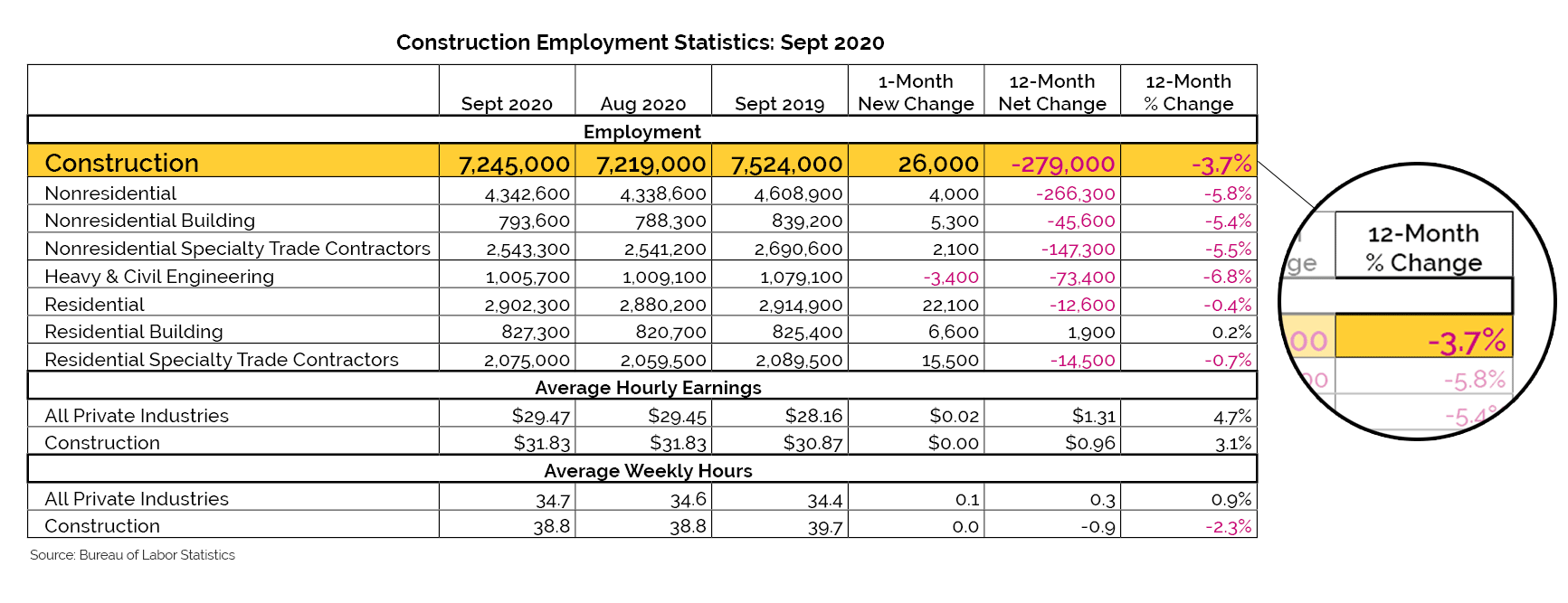

Nonresidential construction employment is down 3.7% from one year ago, however we are seeing improvements over one month.

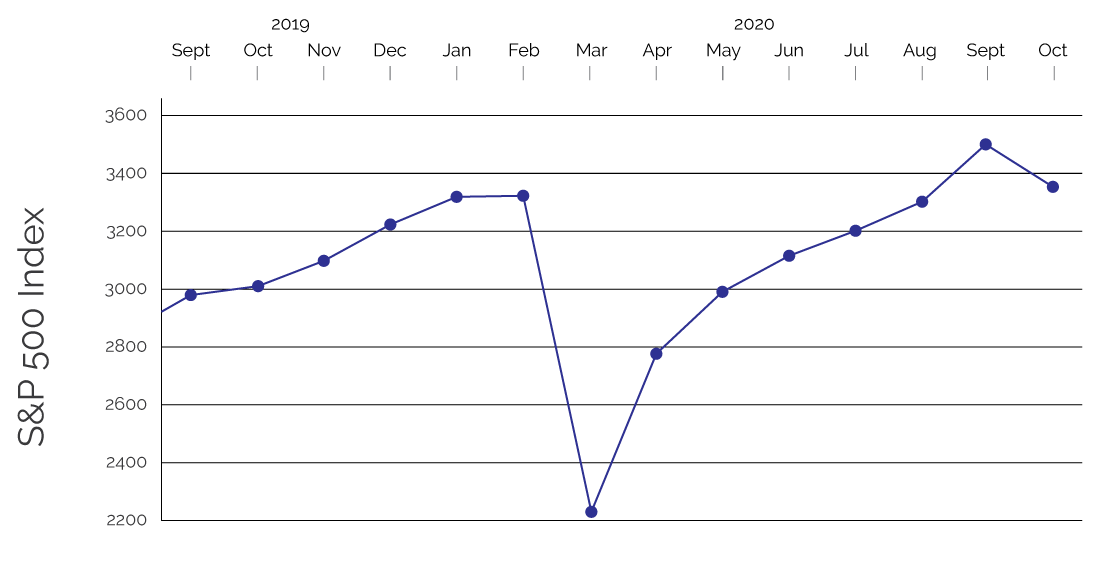

Using the S&P 500 as an indicator, the stock market has bounced completely back from early Covid-19 lows. The S&P 500 had a pre Covid high of 3,386.15 on 2/19/20. At the worst point in the Covid crisis, the S&P hit a low of 2,191.86 on 3/23/20. By 9/2/20, the S&P has regained all the lost ground and hit a new 2020 high of 3,588.11.

Since that high on 9/2/20, the S&P has fluctuated up and down, most recently closing at 3,483.34 on 10/19/20, still dramatically higher than the drastic lows during the early Covid days.

Unemployment fell from 8.4% to 7.9% continuing the trend of recovery.

With signs of recovery, inflation for 2020 has tracked up from near zero to above 1%.

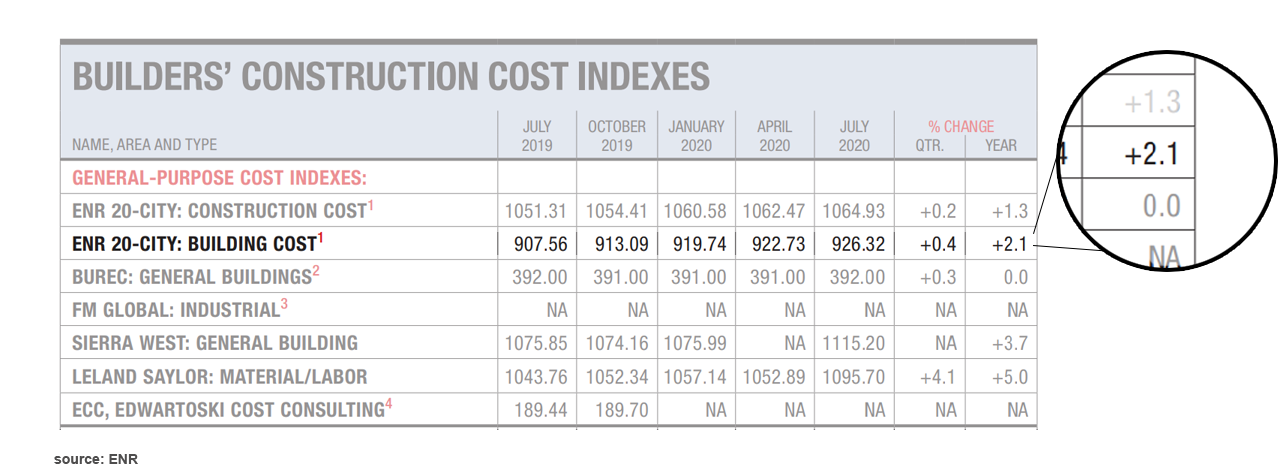

2020 Q2 appears to match Q1 trends (approx. 2%).

Nationally:

CT / Northeast:

Nationally:

CT/ Northeast:

Summary Opinion:

As with our previous quarterly opinion, we still believe that the remainder of 2020 and possibly the first half of 2021 would be an advantageous time to bid and /or start a construction project

Due to confidence issues, as well as cyclical events, and reduction in demand there should be a great number of qualified construction firms competing for work in an attempt for them to build back log. This level of competition should allow inflation to remain low in the short term.